What is the African Continental Free Trade Area (AfCFTA)?

The African Continental Free Trade Area (AfCFTA) is a comprehensive and ambitious free trade agreement that seeks to bring together all 55 members of the African Union (AU) into an integrated and combined market of 1.4 billion, with a GDP of approximately US$3.4 trillion.

The AfCFTA is a flagship project of the AU Agenda 2063. It establishes a framework for tariff liberalisation across the African continent and harmonises trade-related rules to encourage greater flows of intra-African trade and investment. It preserves current sub-regional arrangements, such as the Southern African Development Community (SADC), the Southern African Customs Union (SACU), and the East African Community (EAC).

The AfCFTA is anchored on the development integration approach, which places emphasis on market integration, industrialisation and infrastructure development to support the continental objectives of sustainable development and economic growth. Ultimately, the AfCFTA is Africa’s strategy to attain industrialisation, sustainable economic growth, and job creation on the continent.

If fully and effectively implemented, the AfCFTA will create a predictable and conducive trading and investment environment, and help facilitate direct investment since it establishes harmonised and uniform rules for trade, investment and intellectual rights protection across the African continent.

If fully and effectively implemented, the AfCFTA will create a predictable and conducive environment for trade and investment. It will also facilitate direct investment by establishing harmonised and uniform rules for trade, investment, and intellectual property rights protection across the African continent.

In support of these objectives, the AfCFTA is a comprehensive agreement that includes protocols on (i) trade in goods, (ii) trade in services, (iii) competition policy, (iv) intellectual property rights, (v) investment, (vi) digital trade, (vii) women and youth in trade, and viii) rules and procedures for the settlement of disputes.

Benefits of the AfCFTA

The AfCFTA offers an opportunity to build economies of scale and improve the efficiency of the continental market, thereby improving Africa’s competitiveness both in its own markets and globally.

The AfCFTA is expected to facilitate and enhance intra African trade through:

- Progressive elimination of tariffs

- Progressive liberalisation of trade in services

- Rules to manage non-tariff barriers

- Cooperation on customs, trade facilitation and transit

- Enhanced cooperation on technical barriers to trade and sanitary and phyto-sanitary measures

- Legal certainty and predictability of market access

- Legal framework for the resolution of trade disputes

- Stimulate Africa’s industrial development and employment

- Promote, facilitate and protect investments and intellectual property rights

The successful implementation of AfCFTA is expected to lead to:

- Diversification of exports

- Increased productive capacity

- Increased entrepreneurial opportunities

- Acceleration of growth

- Increased investment

- Increased technology transfer

- Increased employment opportunities and incomes

- Broadening economic inclusion

For South Africa, the AfCFTA presents opportunities to expand exports into new preferential markets in East, West, Central, and North Africa. It also offers an alternative market for the export of value-added goods and service

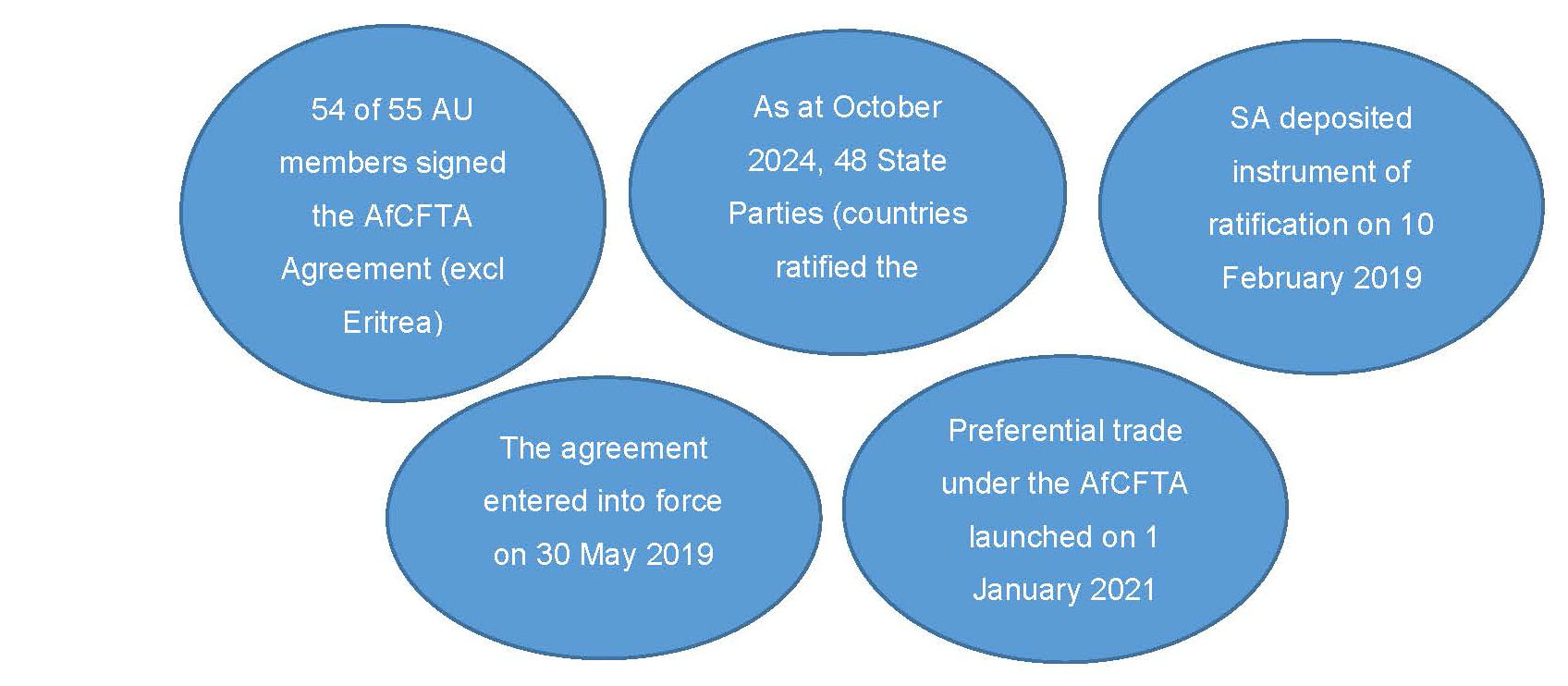

PROGRESS

- The Trade in Services Protocol currently focuses on five priority sectors: Financial, communications, transport, tourism, and business services. It outlines provisions for general obligations, disciplines, and the progressive liberalisation of trade in services, with additional sectors to be negotiated in the future.

- The Trade in Goods Protocol comprises nine annexes, addressing areas such as the Schedule of Tariff Concessions, Rules of Origin, Customs Cooperation and Mutual Assistance, Trade Facilitation, Non-Tariff Barriers, Technical Barriers to Trade, Sanitary and Phytosanitary Measures, Transit, and Trade Remedies.

- Technically verified Provisional Schedules of Tariff Concessions (PSTCs) from the State Parties can be accessed via https://etariff.au-afcfta.org

- South Africa commenced preferential trade under the AfCFTA on 31 January 2024, following the gazetting of the SACU joint offer/Provisional Schedule of Tariff Concessions covering 90% of the tariff book in terms of Section 48 of the Customs and Excise Act, 1964, Amendment of Schedule No.1.South Africa is now able to trade preferentially with those countries that have started implementing their tariff preferences, including Algeria, Burundi, Cameroon, Egypt, Ghana, The Gambia, Kenya, Morocco, Rwanda, Tunisia and Uganda However, for SADC countries that are party to the SADC Trade Protocol, South Africa will continue to trade under the SADC preferences

- The Protocol on the Rules and Procedures for the Settlement of Disputes establishes a Dispute Settlement Mechanism, as outlined in Article 20 of the AfCFTA Agreement. This mechanism facilitates the resolution of disputes between State Parties through the creation of a Dispute Settlement Body (DSB).

- The Protocol on Competition Policy establishes an integrated and unified African continental competition regime. It aims to enhance competition within the AfCFTA, promoting improved market efficiency, inclusive growth, and the structural transformation of African economies. This Protocol will enter into force upon ratification by 22 State Parties.

- The Protocol on Investment establishes a balanced, predictable, and transparent continental legal and institutional framework for investment. It considers the interests of State Parties, investors, and local communities, fostering intra-African investment flows and facilitating the retention, protection, and expansion of investments that support the sustainable development of African countries. This Protocol requires ratification by 22 State Parties to come into effect.

- The Protocol on Intellectual Property Rights establishes common rules and principles for the promotion, protection, cooperation, and enforcement of intellectual property rights. It aims to foster intra-African trade, stimulate African innovation and creativity, and deepen intellectual property culture across the continent. This Protocol requires ratification by 22 State Parties to enter into force.

- The Protocol on Women and Youth in Trade aims to enhance the effective participation of women and youth in intra-African trade. It promotes the mainstreaming of women and youth in trade-related activities as part of the AfCFTA’s implementation, contributing to sustainable economic development at national, regional, and continental levels. This Protocol requires ratification by 22 State Parties to enter into force.

- The Protocol on Digital Trade establishes harmonised rules, principles, and standards to facilitate and support digital trade for sustainable and inclusive socio-economic development. It promotes digital transformation and intra-African digital trade by removing barriers to digital trade among State Parties. This Protocol requires ratification by 22 State Parties to enter into force.

President Ramaphosa, the President of South Africa, officially launched the commencement of preferential trade under the AfCFTA at the Port of Durban on 31 January 2024. The event marked the dispatch of consignments of value-added manufactured products to Ghana and Kenya

For queries contact AfCFTA@thedtic.gov.za

Useful links:

- The AfCFTA official website: https://au-afcfta.org/

- AfCFTA e-Tariff Book https://etariff.au-afcfta.org

- AfCFTA Hub: https://hub.au-afcfta.org/

- AfCFTA Non-Tariff Barrier (NTB) Online Mechanism https://www.tradebarriers.africa

- AfCFTA Rules of Origin Appendix: https://etariff.au-afcfta.org/rulesoforigin

- Weblink for the publication notifying South Africa’s commencement of trading under the AfCFTA: Notice R.4287; https://www.sars.gov.za/wp-content/uploads/Embargo/Tariffs/2024/Legal-LSec-CE-TA-2024-16-Notice-R4287-G-50045-Sch-1-1-1892-Substitution-General-Note-O-to-implement-the-AfCFTA-Agreement-26-January-2024.pdf

FAQs

- Would South Africa be able to trade with SACU and SADC countries under the AfCFTA?

No. The AfCFTA builds on the existing regional economic integration achieved through the Regional Economic Communities. South Africa will, therefore, not trade preferentially with SACU and SADC Member States under the AfCFTA. South Africa, as a member of SACU, will continue to trade with SADC Member States that are party to the SADC Trade Protocol under this preferential SADC arrangement.

- How is tariff liberalisation implemented?

Tariff liberalisation under the AfCFTA is effective from 1 January 2021, and will be undertaken through the progressive elimination of duties in equal installments, as follows:

- 90% coverage of tariff book (Category A) over a period of between five and 10 years.

- 7% coverage of tariff book (Category B – sensitive products) over a period of between 10 and 13 years.

- 3% coverage of tariff book (Category C – excluded products) – exempt from tariff liberalisation.

By 2035, it is expected that 97% of tariffs would be a zero duty.

- Is South Africa able to trade with all African countries under the AfCFTA?

At this stage, South Africa will be able to trade preferentially only with member states that have started implementing AfCFTA preferential trade. This means they must have ratified the Agreement and gazetted their Tariff Schedules. As of October 20241, only 19 countries, including SACU, have gazetted their Tariff Schedules; namely Algeria, Burundi, Botswana, Cameroon, Egypt, Eswatini, Ghana, Kenya, Lesotho, Malawi, Mauritius, Morocco, Rwanda, Seychelles, South Africa, Tanzania, The Gambia, Tunisia and Uganda. More countries are expected to gazette or domesticate their tariff schedules and start trading with South Africa over the coming months.

Trade with SADC2, including SACU countries, will continue to take place under the respective SACU Agreement and the SADC Trade Protocols not under the AfCFTA.

- What is the difference between the Provisional Schedule of Tariff Concessions and the Final Schedules of Tariff Concessions?

The Provisional Schedule of Tariff Concessions cover 90% of the tariff books (Category A) and provides for the commencement of preferential trade until the negotiations of the remaining 7% and 3% have been finalised. The final schedules of tariff concessions will be appended to the Agreement once all three categories have been finalised and approved by the African Union Heads of State and Government.

- What is the starting date for the implementation of tariff reductions?

Preferential trade under the AfCFTA commenced on 1 January 2021, as agreed by the African Union Heads of State on products with agreed Rules of Origin and subject to the adoption and gazetting/domestication of tariff schedules. This means that tariff duties must be reduced from the baseline of 1 January 2021.

- Where can I confirm if my product can be exported under the AfCFTA preferences and what the current duty is?

The adopted Tariff Schedules can be accessed on the AfCFTA e-tariff book at https://etariff.au-afcfta.org

- What are Rules of Origin?

Rules of Origin are the criteria that are used to define where a product was made. The origin of a product is important because it will determine how it is treated at the border of an importing country, and may impact on the import duty payable by the country. Where Africa has the capacity to produce sufficient quantities of a product (e.g. raw sugar), we negotiate for a wholly obtained rule. This means that for a product to enjoy preferential treatment, it must be completely produced or sourced in Africa. Where Africa does not have sufficient supply or the capacity to produce a product, rules that allow for a percentage of products or inputs from outside the continent are considered and allowed.

- What is the Certificate of Origin?

A Certificate of Origin is a document used in international trade to identify a product’s country of origin. The Certificate of Origin will also detail the product’s specifications and the identities of the exporter and importer. The Certificate of Origin is used for customs purposes, especially when a tariff or other import duty is required.

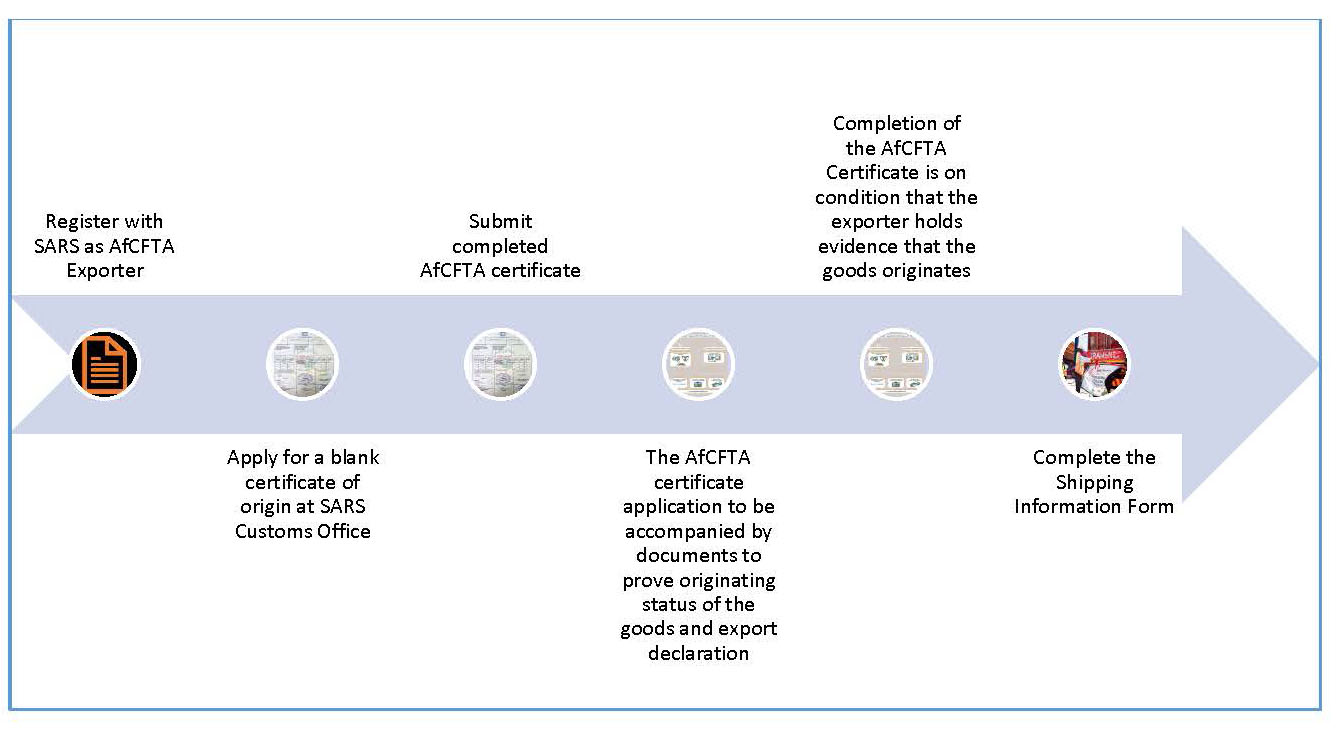

- Where do I obtain the Certificate of Origin for the AfCFTA and what is the process?

You should contact SARS to obtain a Certificate of Origin for preferential trade under the AfCFTA. The SARS email address is rulesoforigin@sars.gov.za

Process to register with SARS as an AfCFTA Exporter

- Are the Phase II Protocols being implemented?

No, not yet. The Phase II Protocols on Investment, Competition Policy, Intellectual Property Rights, Digital Trade, and Women and Youth in Trade form an integral part of the Agreement. Since these protocols were negotiated after the Agreement entered into force in May 2019, they will need to be individually ratified by a minimum number of 22 Member States before entry into force.

- Where can I register a Non-Tariff Barrier (NTBs)?

The Protocol on Trade in Goods provides for a mechanism for the identification, categorisation and progressive elimination of NTBs within the AfCFTA. Any economic operator (i.e. the beneficiaries of NTB resolution, which are the private sector, especially SMEs in the context of Africa) may register a complaint.

The ACFTA NTBs Online Reporting Mechanism has been established and can be accessed on the following link: https://tradebarriers.africa. However, companies are encouraged to liaise with the dtic to assist in the resolution of any NTB with the relevant Member State.