Chemicals

The South African chemicals industry plays a critical role in the South African economy. It is interwoven with the South African manufacturing sector – contributing significantly to South Africa’s manufacturing production; it also produces key outputs used across the economy. The industry is complex and diverse with different sub-sectors. The industry has experienced strong growth in recent years, with local chemicals sales growing at a CAGR of 7.6% between 2006 and 2016 (MarketLine, 2016). While the local chemicals manufacturing sector has proved resilient in the face of increased exposure to global competition, with local production output growing at a CAGR of 3.6% between 2001 and 2016, the sector has been unable to capitalise on local market growth, with imports having been the primary beneficiary.

2017 Annual Performance and Trade Data

In 2017 the chemical sector (excluding plastics), contributed 2.92% to national GDP, 21.4% to manufacturing GDP and employed 105 690 people. These figures are an increase compared to 2016 figures. The main contributors to the job increase of 4094 people are the Petroleum chemicals (1910 people), Basic chemicals (497 people) and Other chemicals (1687 people). The Other chemicals category also includes Pharmaceuticals and Cosmetics industries. The trade data shows that the sector continues to import more than it exports with the organic chemicals and miscellaneous products the biggest contributor to trade deficit. The exports showed improvement in 2017 resulting in around R3.3 billion decrease in the trade deficit.

Key Economic Data

| 2016 | 2017 | |

| %Contribution to GDP | 2.68% | 2.92% |

| %Contribution to manufacturing | 19.5% | 21.4% |

| Employment | 101 596 | 105 690 |

| Imports (R Billion) | 73.3 | 76.7 |

| Exports (R Billion) | 52.4 | 59.1 |

| Trade Balance (R Billion) | -20.9 | -17.6 |

Sector strategy

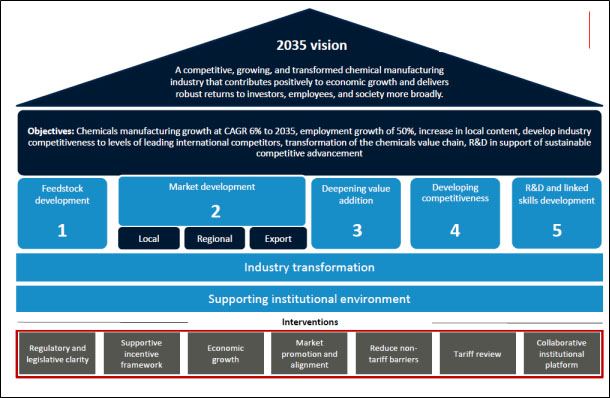

In 2017, the Industrial Development Division identified the lack of current strategy for the chemical sector as a short coming that inhibits the development of sound key action programmes for the industrial policy action plans (IPAP). This required an evidence-based policy position that will support the South African chemical industry to withstand and grow in the volatile and difficult-to-forecast global and domestic markets. This therefore led to the development of a new strategy built from existing chemical strategies and policies while incorporating the current and future economic outlook for South Africa as well as consultations with industry representatives through the Industry Reference Group (IRG) and individual company interviews. The strategy will serve as a platform to translate key strategic challenges facing the sector into goals and key action programmes that will achieve sustainable growth, increase employment and investment across the sector.

The sector strategy has been developed and the summary depicted below (figure1), with the strategic objective and vision set out, the strategic pillars defined with five key areas of focus and two cross-cutting elements and an overview of strategic interventions outlined.

Figure 1: Summary of the South African Chemicals Strategy

The sector desk will use the strategy as a guide to address the challenges faced by the sector, to scope out opportunities by developing key action programmes to grow and develop the sector and implement the recommendations in partnership with stakeholders

[print-me]