National Liquor Authority

Compliance with the National Liquor Act

The following information seeks to clarify the compliance requirements for current and prospective NLA registrants.

The National Liquor Authority (NLA) administers the Liquor Act No. 59 of 2003 by registering manufacturers and distributors of liquor.

Conditions of Trade

- To ensure the objects of the Act are achieved, registrants are required to comply with general and specific conditions of trade. The conditions are set out in form NLA 8 and are agreed upon by the registrant and NLA prior to the issuance of the registration certificate (NLA 9).

- General conditions are applicable to all registrants. Specific conditions are unique to a registrant as they are based on whether the registrant has or has not met certain registration requirements.

General Conditions

- The liquor products to be manufactured and/or distributed should comply with the definition of liquor as provided in section 1 of the Liquor Act No. 59 of 2003 and/or the definition of liquor products as provided in the Liquor Products Act No. 60 of 1989, as amended;

- The registered activities should be conducted at or from registered premises and at a location approved by the relevant local authority. Proof of approval from the local authority should be provided within 30 days prior to issuance of a registration certificate;

- Liquor may only be distributed to registered persons/entities or other licensees;

- The sale, directly or indirectly, to the public and the consumption of liquor is not permitted on the premises;

- The applicant/registrant must not employ a person who has not attained the age of 16 unless the employee is undergoing training or learnership contemplated in section 16 of the Skills Development Act No. 97 of 1998;

- The applicant/registrant must comply with the Customs and Excise Duties Act No. 91 of 1964 as amended; and

- The registrant must comply with all the provisions of the Liquor Act No. 59 of 2003 and/or any other relevant law.

Specific Conditions

- Specific conditions are imposed on the different categories of applicants and registrants.

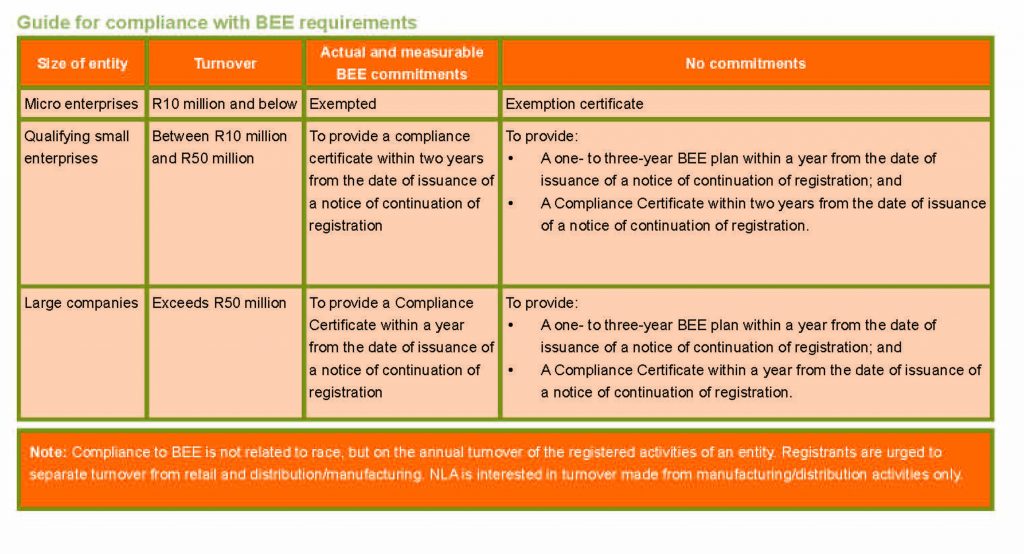

- Categories are based on the size of entities, i.e. small, medium and micro enterprises (SMMEs) and large entities. The turnover of the entity determines its size and different conditions are imposed on the different sizes of entities.

Guide for Compliance Regarding Combating Liquor Abuse

-

- The applicant or registrant is required to propose financial or non-financial contributions aimed at combating liquor abuse.

- An applicant or a registrant who proposes financial contributions to combat liquor abuse should contribute 1% of the entity’s annual net profit before tax and affiliate to a specific organisation dealing with matters relating to liquor abuse, rehabilitation centres, and research and development institutions aimed at combating liquor abuse and similar organisations.

- The contribution should be made within a year from the date of issuance of the registration certificate and annually thereafter. The registrant needs to submit proof of this contribution.

- An applicant or registrant who proposes non-financial contributions to combat liquor abuse should affiliate to an industry organisation.

The applicant should further provide to the NLA proof of subscription, within a year from the date of issuance of a registration certificate and annually thereafter. In the event that the registrant/ applicant does not choose any of the two above options, the entity should develop and implement a programme with annual costs not less than 1% of Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA). In addition, the entity will be required to provide documentary evidence annually of implementation of the programme.

Zoning

- The Act requires that every registered activity takes place from registered premises. As highlighted above, registered premises need to be zoned for business purposes as per the municipal by-laws. Registrants are encouraged to ensure that they trade from premises approved by the local authority that permits distribution or manufactoring

- Relocations are to be made to zoned areas. The NLA needs to be informed of any relocation in a prescribed manner and form (NLA14) and pay the relevant fees.

Renewal

- A macro-manufacturer or distributor of liquor registered by the NLA should renew registration on an annual basis by completing form NLA 28 and paying the prescribed fee at least one month before the anniversary date of their registration certificate.

- Form NLA 28 gives clear instructions on what information to attach when renewing a registration. Additional information should be provided on separate sheets, which will be attached to Form NLA 28. A renewal fee should be paid when submitting the form.

Transfer, Relocation, Alteration, Acquisition of Control

- Registrants who wish to transfer their registration certificate, relocate from registered premises, alter the conditions of their registration or acquire control of another registrant need to inform the NLA in a manner and form (NLA14) prescribed by the regulations and pay the prescribed fees.

Inspections

- Inspectors of the NLA are appointed by the Minister of Trade and Industry. Some of the appointed inspectors are members of the SAPS. Inspectors should be able to identify themselves with an inspector’s certificate.

- Routine inspections are undertaken at premises at least two times a year and the following needs to be readily available at the premises any time that an inspector may come for an inspection:

Original or certified copies of:

- Registration certificate (NLA 9)

- Conditions of registration (NLA 8)

- Renewal certificate (NLA 33)